How to Evaluate a Franchise Opportunity

Investing in a franchise can be an exciting path to business ownership, but not all opportunities are created equal. A strong franchise can offer proven systems, brand recognition, and ongoing support, while a poorly structured one may lead to costly mistakes. Smart buyers perform thorough franchise evaluation before signing any agreement.

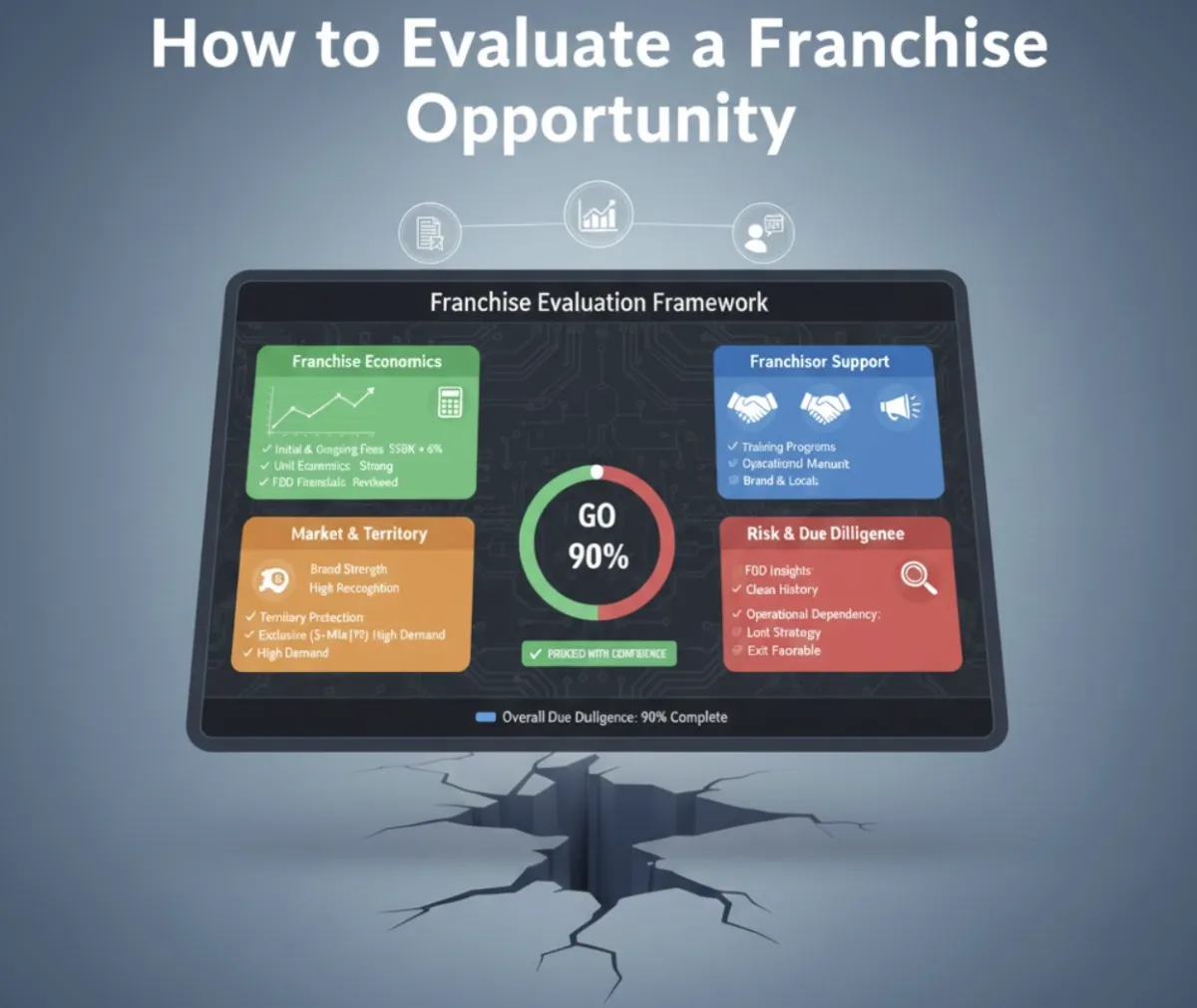

A 4-Stage Franchise Evaluation Framework

When considering a franchise, use this structured approach:

1. Assess Franchise Economics

Initial and ongoing fees: Understand franchise fees, royalty percentages, and marketing contributions.

Unit economics: Evaluate profit margins, break-even timelines, and cash flow potential.

Financial documentation: Review the Franchise Disclosure Document (FDD) for historical performance data.

2. Review Franchisor Support

Training programs: Check if the franchisor offers comprehensive onboarding.

Operational manuals: Ensure clear, systemized processes exist.

Marketing and advertising support: Confirm brand-level campaigns and local marketing guidance.

3. Examine Market and Territory

Brand strength: Evaluate customer recognition and reputation.

Territory protections: Ensure clear geographic boundaries to avoid conflicts.

Competition and growth potential: Analyze local market demand and saturation.

4. Conduct Risk and Due Diligence Checks

FDD insights: Investigate litigation, termination history, and franchisee satisfaction.

Operational dependencies: Identify reliance on franchisor systems or specific suppliers.

Exit strategies: Consider resale potential or buyback options.

Key Signals for a Franchise-Ready Buyer

Transparent FDD disclosures

Strong unit-level profitability

Proven operational systems

Positive franchisee feedback

Realistic growth projections

Best Practices Before Committing

Talk to current and former franchisees for insights

Verify legal and financial claims in the FDD

Conduct a territory analysis

Map out 90-day and first-year operational plans using YourNextVenture.ai 90-Day Success Checklist

Compare multiple franchise opportunities using Franchise Evaluation Templates

Real Example: What to Avoid

A buyer once considered a popular food franchise but skipped thorough diligence. Hidden fees, weak training, and high supplier dependency led to cash flow issues. The lesson: never overlook franchise diligence.

Franchise Evaluation Quick Wins Checklist

Task Action Review FDD Analyze fees, litigation, and financials Talk to Franchisees Ask about support, profitability, and pain points Assess Territory Confirm exclusivity and market potential Calculate Unit Economics Project revenue, costs, and ROI Check Support Systems Evaluate training, marketing, and operations manuals

FAQ

Q: What is franchise evaluation and why is it important?

A: It’s the process of assessing fees, systems, support, and market potential to ensure a viable investment.

Q: How do I perform franchise diligence effectively?

A: Use the FDD, talk to franchisees, verify financials, and analyze operational dependencies.

Q: What are common red flags in a franchise?

A: High turnover, unclear territory protections, hidden fees, and weak franchisor support.

Q: Should I rely on franchisor-provided data alone?

A: No, corroborate with franchisee interviews, independent research, and market analysis.

Q: How does systems maturity affect my decision?

A: Strong, repeatable systems reduce operational risk and make the franchise easier to scale.

Conclusion

Ready to evaluate franchise opportunities and make informed investment decisions? Explore YourNextVenture.ai business acquisition certification and due diligence checklist to get started.