What Are the Costs Most Buyers Forget?

Acquiring a business is thrilling—but focusing solely on the purchase price is a common mistake. Many buyers are surprised by hidden costs and overlooked expenses that surface after closing. From working capital needs to onboarding and post-close improvements, understanding these financial and operational risks is critical for a smooth transition and sustainable growth.

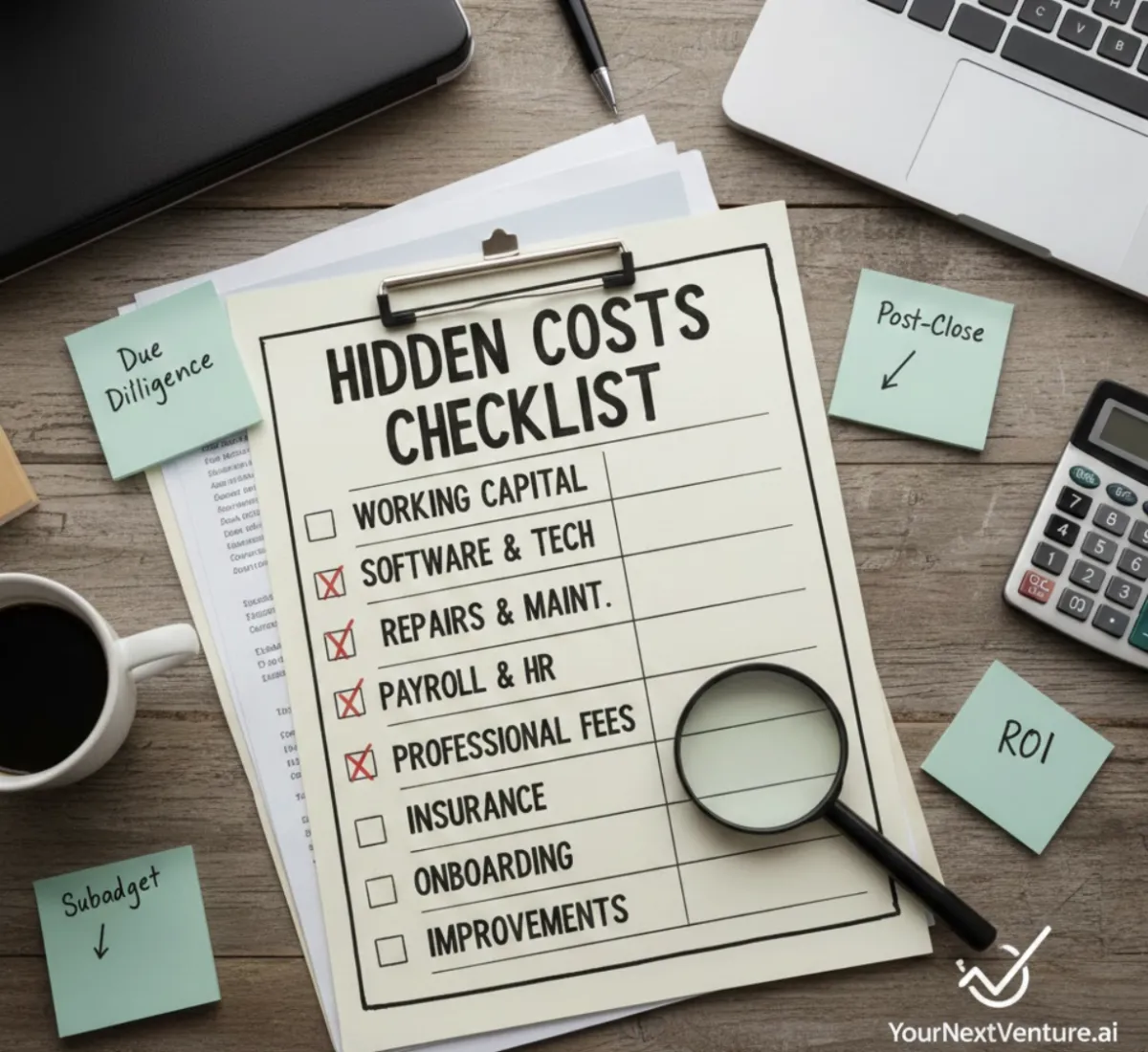

A Strategic Framework for Identifying Hidden Costs

Real operators use a structured approach to anticipate costs before they hit. Consider these key categories:

1. Working Capital Needs

Cash required to maintain day-to-day operations.

Inventory replenishment, supplier payments, and buffer funds.

2. Software and Technology

Legacy systems may need updates or replacements.

SaaS subscription increases and integration costs.

3. Repairs and Maintenance

Deferred equipment or facility maintenance.

Compliance upgrades for safety and operations.

4. Payroll and HR Adjustments

Retention bonuses and salary increases.

New hires to support operational growth.

5. Professional Fees

Ongoing legal, accounting, or consulting support.

Closing gaps in due diligence that require post-purchase advisory.

6. Insurance Premiums

Coverage for liability, property, and workers’ compensation.

Identifying gaps that require immediate investment.

7. Onboarding and Training

Employee onboarding for leadership transitions.

Training for process adoption and operational continuity.

8. Post-Close Improvements

Marketing campaigns, product updates, or facility upgrades.

Operational efficiencies and system optimization.

Leverage tools like YourNextVenture.ai’s Due Diligence Checklist to map these costs systematically.

Real-World Example

A buyer acquired a small service business that seemed profitable. Within months, unexpected expenses included:

$30,000 for overdue equipment maintenance.

$15,000 integrating new software.

Payroll increases to retain key staff.

Anticipating such hidden costs allows buyers to plan capital allocation strategically.

Quick Reference Hidden Costs Checklist

Cost Category Common Oversight Action Step Working Capital Insufficient cash buffer Analyze past cash flows Software Subscription renewals or updates Audit current licenses Repairs & Maintenance Deferred repairs Conduct thorough facility/equipment review Payroll & HR Retention/hiring costs Review contracts and staffing needs Professional Fees Unexpected advisory fees Budget post-close consulting Insurance Coverage gaps Consult broker to ensure adequate coverage Onboarding & Training Knowledge transfer inefficiencies Plan structured training programs Post-Close Improvements System/process upgrades Prioritize based on ROI

FAQs

Q1: What are hidden costs in a business acquisition?

Hidden costs include all post-purchase expenses outside the purchase price, such as working capital, software, repairs, and onboarding.

Q2: How do overlooked expenses impact profitability?

They can reduce cash flow, delay operational improvements, and create unforeseen financial pressure.

Q3: Can professional fees be anticipated?

Yes. Allocating budget for legal, accounting, and consulting support post-close helps avoid surprises.

Q4: How should I plan for payroll-related costs?

Evaluate employee retention, salary adjustments, and any new roles required to maintain operational effectiveness.

Q5: What tools help identify these costs?

YourNextVenture.ai provides assessments, guides, and frameworks to identify and manage overlooked business purchase costs.

Q6: How can I minimize hidden cost risks?

Use structured due diligence, realistic budgeting, and operator-tested frameworks to forecast expenses before closing.

Conclusion

Ready to uncover hidden costs and create a smooth acquisition plan? Explore YourNextVenture.ai’s tools and workshops to ensure operational readiness and maximize ROI from day one.